René Nourse CFP®, PhD

Wealth Advisor

"After 25 years as a financial advisor in the corporate world, I left a major firm in June 2012 to co-found UWM, along with April Charles. We recognized a shift was taking place in the financial services industry, my intention was to build a firm that focused on strategic financial planning alongside investment management to better serve clients. My own personal experience, my mom’s challenges in her life, and her passing in 2017 truly inspired me to create a culture that supports the needs of women too.

The longer I was in the business, the more I realized that women were being overlooked and underserved, both as clients and professionals. I co-founded UWM to create an environment where individuals and families can feel understood, supported, and included.

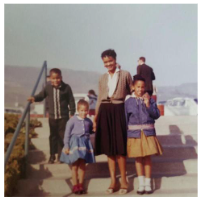

My mom influenced me beginning at a very early age. After her marriage ended, she made the momentous decision to return to graduate school. Although she was a single mom to three children, all under the age of 10, she acquired her master's degree in Clinical Social Work. She was so dedicated to helping people who were experiencing physical and health issues. But working long hours, raising 3 kids, and not receiving an adequate amount of childcare benefits or income created financial stress. I remember multiple occasions when she had to drive quickly, rushing to the bank just minutes before it closed to deposit her paycheck. So cash flow was low, and I could see and feel it.

Whenever my siblings and I received money for our birthdays or Christmas gifts, from our grandparents or other family members, she encouraged us to save our money. I began working at age 13, providing tutorial services for elementary school students. My mom asked to borrow money from me periodically to pay for household expenses and always paid it back. So I was engaged in financial stress early on. Over time, that stopped when her income began to rise and my siblings and I began earning a little money part-time, which took care of some of our personal expenses.

In 2008, our mother was diagnosed with dementia, and my siblings and I stepped in to manage her finances. We discovered that she had set aside very little for her own future, despite encouraging her children to save. My mother was fortunate she had family, but how about others? Will they be protected too?

There are many people who are strong, ambitious, and independent just like my mom, and yet have neglected to consider the risks of longevity and the importance of making good financial decisions today so that they can have a comfortable lifestyle tomorrow.

I’m honored to have been a frequent guest speaker and contributor on the topic of women and finance, and also recognized as a trailblazer and financial expert. The legacy I continue to build with my team reflects our firm’s mission: to be a trusted advisor for our clients, offering personalized wealth guidance that grows and adapts alongside their lives. Together with my executive team, April Charles and Lily C. Huber, we are committed to providing continuity, thoughtful guidance, and dedicated support for generations to come."